Category: Activitats

30/09/2021 – Policy-making on International Economic Law Conference: Toward a new Global Tax Treaty on International Tax Cooperation and Global Tax Governance (II Preparatory work)

Book summary: GLOBAL TAX GOVERNANCE. Taxation on Digital Economy, Transfer Pricing and Litigation in Tax Matters (MAPs + ADR) Tax Policies for Global Sustainability. Ongoing U.N. 2030 (SDG) and Addis Ababa Action, Agendas Authors: GLOBAL TAX GOVERNANCE. Taxation on Digital Economy, Transfer Pricing and Litigation in Tax Matters (MAPs +… Read more“30/09/2021 – Policy-making on International Economic Law Conference: Toward a new Global Tax Treaty on International Tax Cooperation and Global Tax Governance (II Preparatory work)”

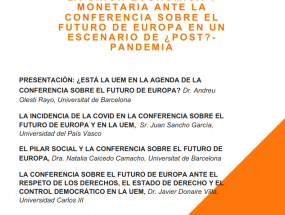

08/10/2021 – Jornadas: La Unión Económica y Monetaria ante la conferencia sobre el futuro de Europa en un escenario de ¿post? -pandemia

“UN WTO action to revive tourism in times of COVID-19” – Laura Huici Sancho presenting during the ESIL Annual Conference in Stockholm

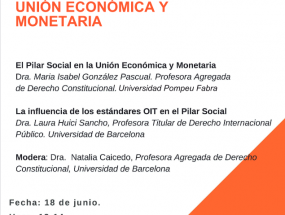

18/06/2021 – Webinar: El pilar social en la Unión Económica y Monetaria

31/05 i 2, 7, 9/06/2021 – Seminari de Formació en Dret Ambiental: “El dret de la Unió Europea davant l’emergència climàtica”

El pròxims mesos de maig i juny, amb la col·laboració de l’Oficina Catalana de Canvi Climàtic del Departament de Territori i Sostenibilitat de la Generalitat de Catalunya i la Clínica Jurídica ambiental del programa “dret al Dret” de la Facultat de Dret de la Universitat de Barcelona, la Càtedra Jean… Read more“31/05 i 2, 7, 9/06/2021 – Seminari de Formació en Dret Ambiental: “El dret de la Unió Europea davant l’emergència climàtica””

18-23/08/2021 – International Congress: “Genocide and Its Prevention in the Digital Age: 21st Century Challenges”

About From the digitalization of archives that document genocide atrocities to the use of this technology in the capture and prosecution of perpetrators, the landscape of interdisciplinary genocide studies and genocide prevention is rapidly changing. As the field of genocide studies has grown and diversified in the 21st century, the… Read more“18-23/08/2021 – International Congress: “Genocide and Its Prevention in the Digital Age: 21st Century Challenges””